A strong building industry is an essential driver of a strong economy. It creates jobs, employs more apprentices and trainees than any other industry, and drives economic growth. Every $1 spent on a construction project in Tasmania generates $3 in wider economic activity.

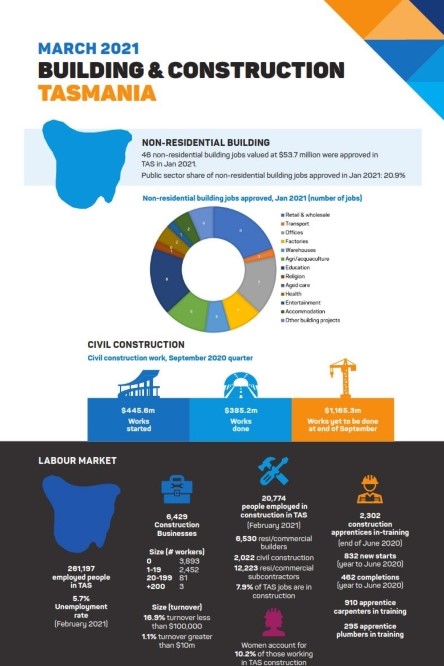

Sustaining our recovery will again rely heavily on the 6,430 businesses and 20,775 workers which make up the construction industry.

Over the past year, Tasmania has been one of only two states to have received a boost to its population through inward migration from other parts of Australia. Tasmania now has one of the fastest growing populations in Australia this will require a considerable building output in terms of housing, schools, hospitals and the supporting infrastructure

over the coming years.

We need a bigger and better skilled building industry to deliver the homes, schools, and infrastructure we will need to support the community.

We’ve been building Tasmania for 130 years. This blueprint is presented to ensure that the construction industry has the support to continue to build a strong Tasmanian economy.

Building a bigger and better economy

Master Builders Australia projects that the volume of construction work done in Tasmania will expand by 8.7% during 2021–22 to reach an all-time high of $3.49 billion. Beyond this ‘hump’ in activity, activity is anticipated to ease back but the scale of activity is still likely to remain very elevated by historic standards. Sustaining a large enough construction workforce will be vital in ensuring that Tasmania’s future building needs are met.

Ranking of Tasmania’s industries according to total employment during February 2021

| RANKING | INDUSTRY | TOTAL EMPLOYMENT |

| 1 | Health care and social assistance | 40,539 |

| 2 | Retail trade | 27,293 |

| 3 | Accommodation and food services | 24,504 |

| 4 | Construction | 20,774 |

| 5 | Education and training | 19,910 |

| 6 | Agriculture, forestry and fishing | 19,604 |

| 7 | Public administration and safety | 19,466 |

| 8 | Manufacturing | 18,918 |

| 9 | Professional, scientific and technical services | 16,619 |

| 10 | Transport, postal and warehousing | 12,116 |

Source: Master Builders Australia analysis of ABS 6291.0.55.003

Total building and construction activity: Master Builders forecasts to 2024–25

Millions of dollars, chain volume measures (2018–-19 prices)

| 2018–19 | 2019–20 | 2020–21 | 2021–22 | 2022–23 | 2023–24 | 2024–25 | |

| Total building & construction activity | $3,247.7 | $3,288.2 | $3,207.8 | $3,487.9 | $3,404.3 | $3,145.8 | $2,907.2 |

| Change on previous year (%) | +15.5% | +1.2% | -2.4% | +8.7% | -2.4% | -7.6% | -7.6% |

| Residential building activity | $984.1 | $1,000.2 | $1,165.1 | $1,045.2 | $935.5 | $946.8 | $964.4 |

| Change on previous year (%) | +16.1% | +1.6% | +16.5% | -10.3% | -10.5% | +1.2% | +1.9% |

| Non-residential building activity | $741.8 | $727.5 | $678.3 | $679.1 | $680.9 | $681.7 | $683.4 |

| Change on previous year (%) | +11.2% | -1.9% | -6.8% | +0.1% | +0.3% | +0.1% | +0.2% |

| Civil and engineering construction work | $1,521.8 | $1,560.5 | $1,364.4 | $1,763.6 | $1,787.9 | $1,517.3 | $1,259.4 |

| Change on previous year (%) | +17.3% | +2.5% | -12.6% | +29.3% | +1.4% | -15.1% | -17.0% |

Source: Master Builders Australia-produced forecasts and analysis of ABS Building Activity (8752.0)

PRIORITY 1: Building Affordable Housing for the Long term

Homeownership is central to the Australian dream. It is part of our national identity. How we continue to keep this dream alive for as many aspirational Tasmanians as possible should be central to any party platform serious about securing the future prosperity of our state.

Building more social housing is crucial. But if we are truly compassionate the goal must be the pursuit of social housing policies that not only build an adequate social housing stock but put measures in place to help people get out of supported housing and into homeownership.

PRIORITY 2: Building Capacity and Skilling for Recovery

Capacity constraints are holding back the construction industry from making even greater contributions to the economic recovery.

The current pipeline of major projects in Tasmania is worth over $16 billion.

We need capacity to build more than 30,000 homes over the next decade to at least keep pace with population growth and put downward pressure on housing prices.

The construction workforce is ranked 6th in Tasmania in terms of size compared to other industries. Nationally the construction workforce is the 3rd largest ranked by industry. We need a much bigger construction workforce in Tasmania to meet future industry needs.

The distribution of training funding across industries does not match the distribution of training needs.

The lack of physical capital and fit-for-purpose training facilities also limits the scope of training services on offer and the ability for the training system to scale up.

Provide extra resources for department procurement agencies, and State Growth to accelerate the delivery and roll-out of major infrastructure projects.

PRIORITY 3: A private investment-lead long term recovery strategy

If we are going to sustain the economic recovery, the private sector is going to have to do the heavy lifting long term.

Commercial construction is highly dependent on private sector investment that in turn is driven largely by investor and business confidence.

One of the lasting impacts of COVID has been a deterioration in private sector investment. At the height of COVID more than $1 billion in projects were flagged as stalled.

Government stimulus that helps to unlock private investment has proven to work.

Building approval statistics for non-residential construction remain well below pre-COVID levels.

The long-term recovery and sustainability in the construction industry will rely on how well and how quickly private sector investment can be encouraged back into Tasmania.

We need a plan to help stimulate commercial construction activity over the long term.

PRIORITY 4: Backing Business to Create More Jobs

The construction sector is overwhelmingly characterised by a highly competitive collection of small and very small firms. 98% of construction firms currently operate as small businesses – many of which are sole traders.

The burden of regulation and bureaucracy is particularly onerous on the small business which make up the building sector.

Businesses which operate in the construction and property sectors are exposed to a greater tax burden than other industries. The impact is lower activity and lower employment.

Inefficient developer taxes, charges and levies, and planning and zoning restrictions imposed upon the building sector raise the cost of building homes and delivering community infrastructure.

Tax relief for small businesses who employ apprentices has been a very successful policy. To be most effective, businesses need longer term certainty given an apprenticeship is a four-year commitment.

PRIORITY 5: Keeping Tasmanians Safe

The majority people’s time is spent inside homes, schools, offices, shops, hospitals, and other buildings produced by the construction industry. Conditions in our sector have a profound impact on the safety, security, and well-being of all Tasmanians.

With over 20,000 Tasmanians employed in construction, working conditions in the sector have a major impact on the physical and mental health of a large share of the population.

There are a growing number of cases in the courts related to build quality and defect issues. This an impost to the courts, to business and to consumers. The current system where consumers in the residential sector are not covered by a compulsorily warranty scheme is a risk.

Master Builders urges a greater focus on recommendations which improve the safety of buildings, those working on construction sites, and maintaining high standards in building quality.

Master Builders Radio Ad 2021

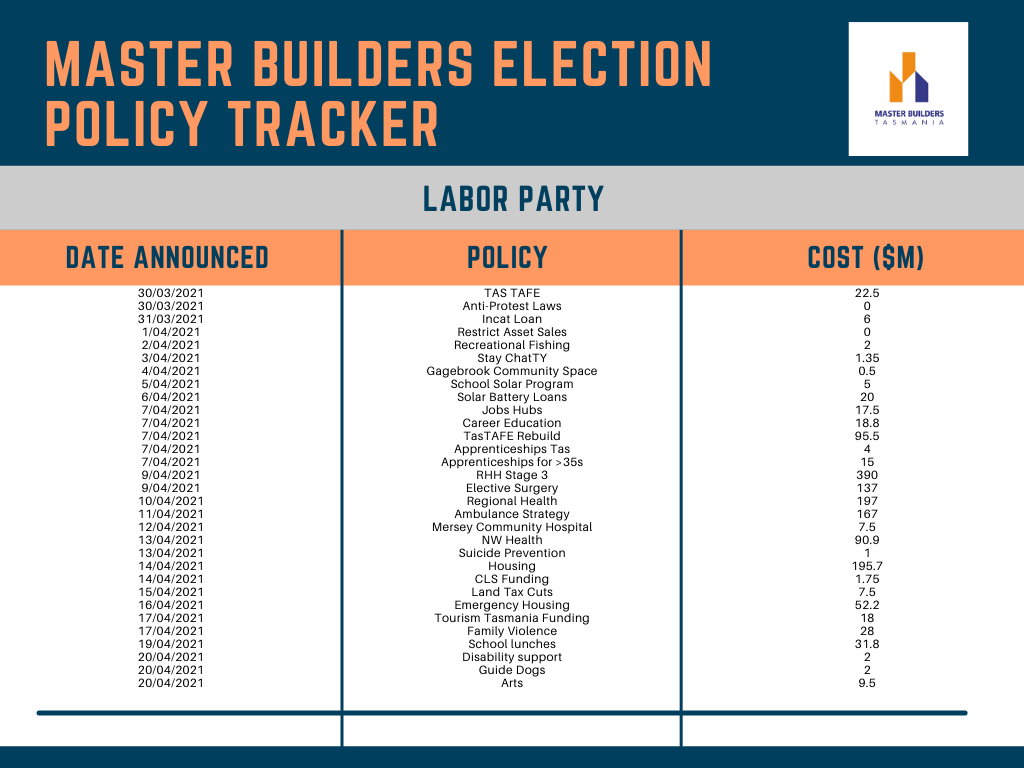

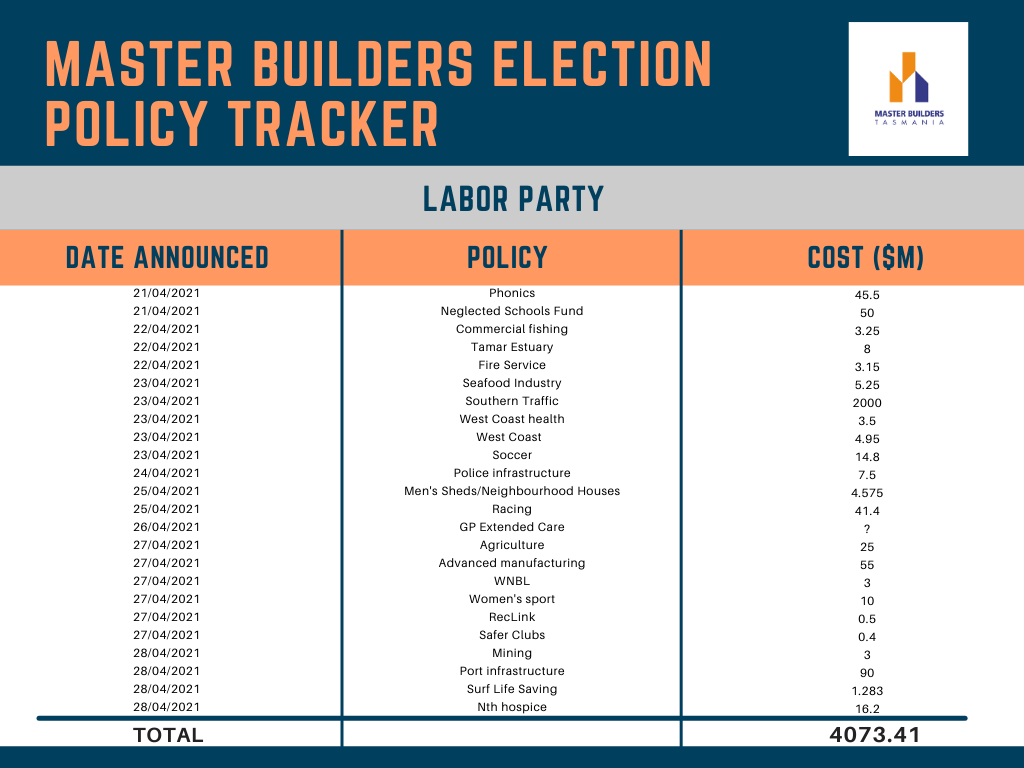

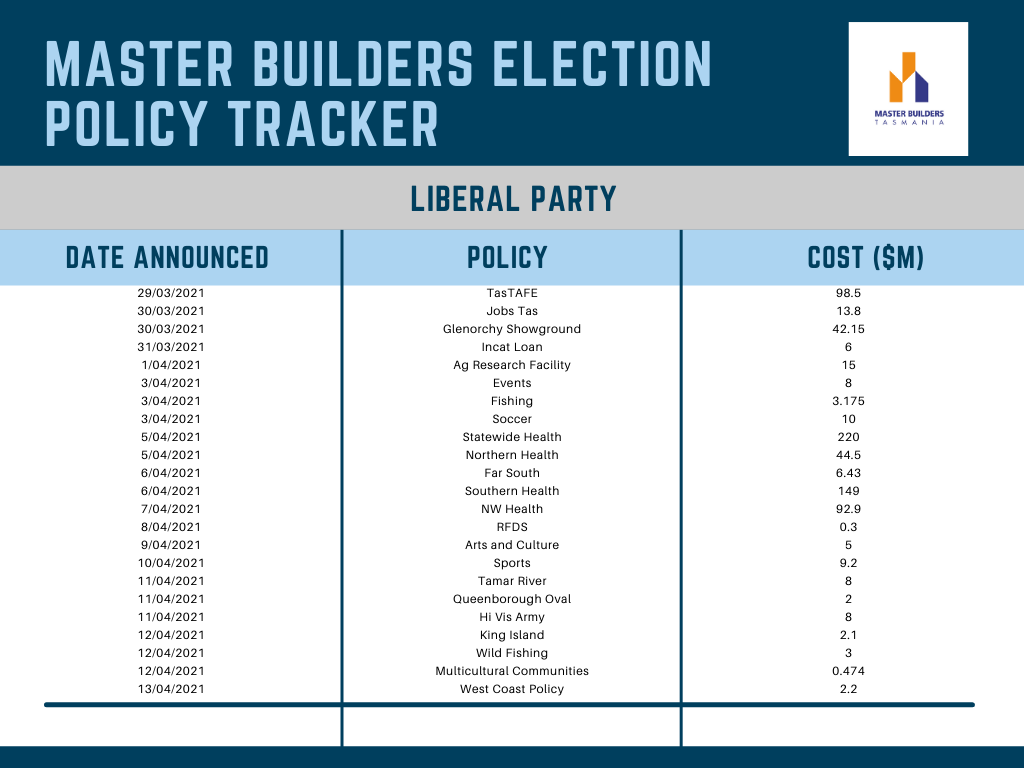

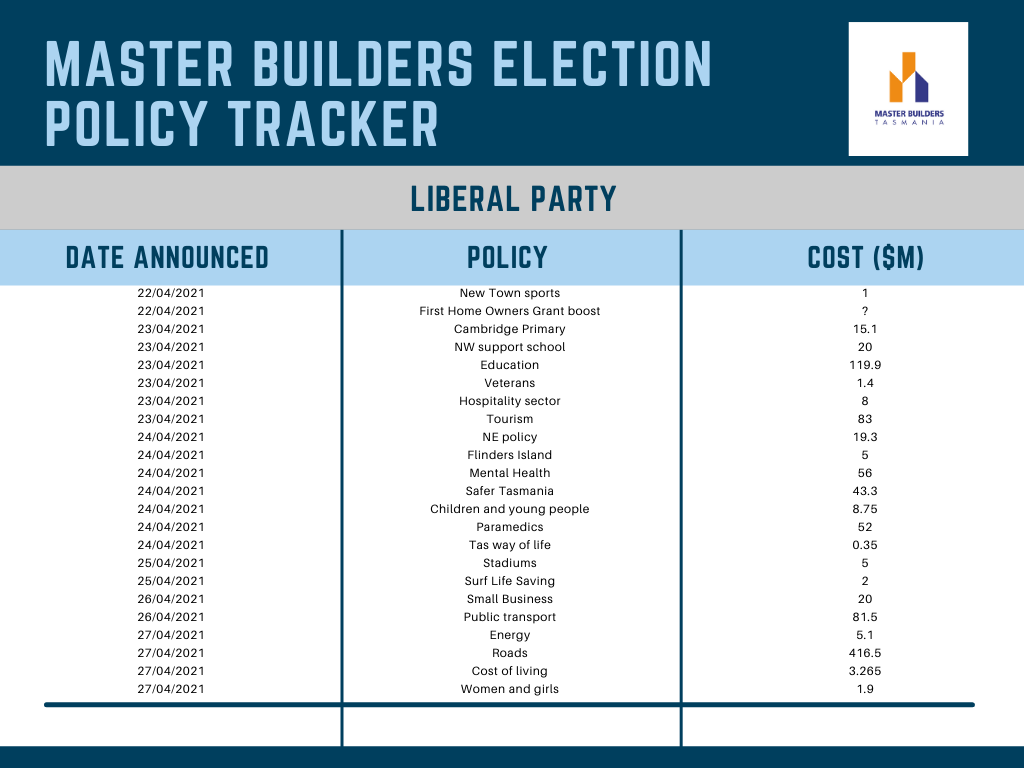

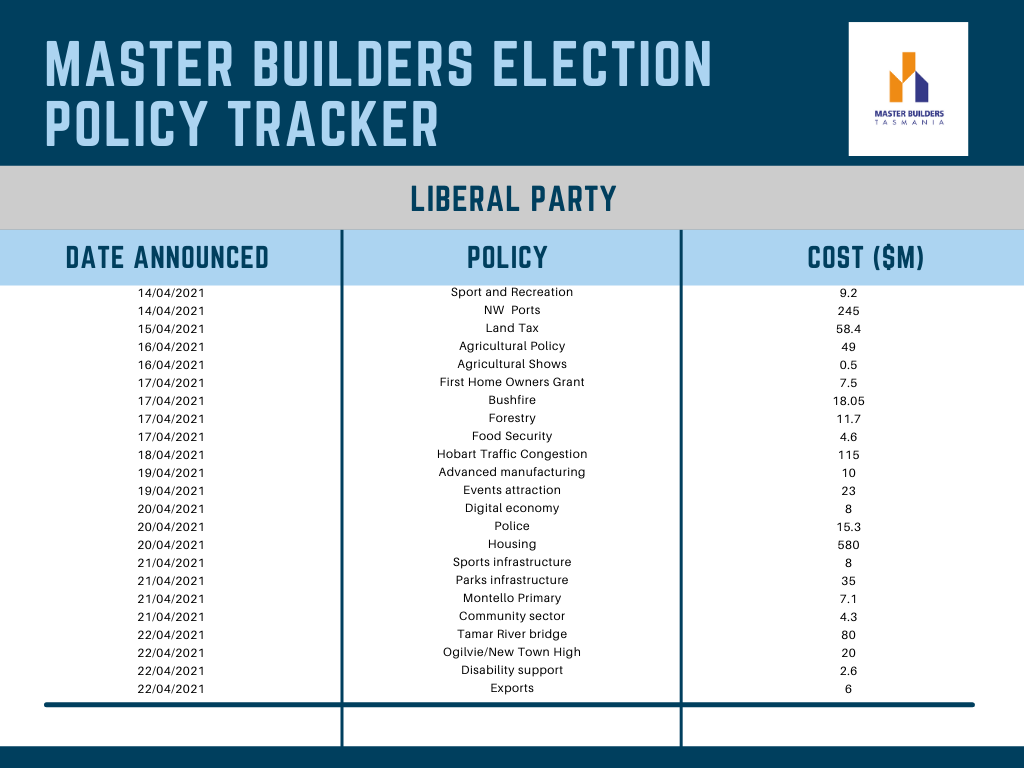

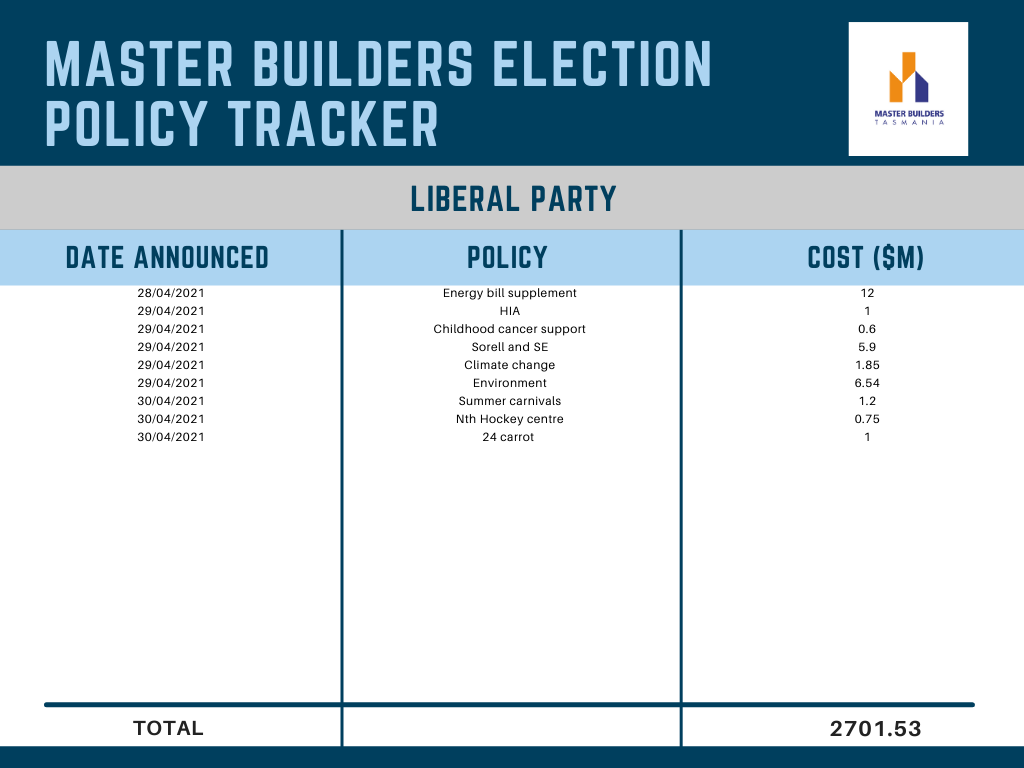

Election Policy Tracker

Election 2021 News

$4 million for Master Builders to Train a Hi-Viz Army

MASTER BUILDERS’ ELECTION POLICY TRACKER – FINAL

Supporting Tasmanian small businesses with a $20 million investment package

ADVOCACY WIN – Community Building Projects Support Program Doubled

Op-Ed EVERYONE DESERVES THE CHANCE TO OWN A PIECE OF PARADISE

Flexibility in HomeBuilder Must be an Election Priority

MASTER BUILDERS’ ELECTION POLICY TRACKER – WEEK 2

Op Ed: The great economic experiment

March 2021 : Building & Construction SnapShot

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)